The Hidden Opportunity in 2025’s “Scary” Market

How to wipe out your housing payment and build wealth on autopilot

Everyone’s terrified of investing in 2025.

Costs are up. Deals are really hard to find. The headlines scream crisis (as they always do).

But quietly, some investors are making more money than ever, because they know how to play the chaos to their advantage.

If you’re sitting on the sidelines, you’re missing the greatest wealth-building window in a decade.

I know because I'm actively investing AND I'm seeing it on the back end with my successful investors I'm providing financing for.

Taming Construction Chaos: Surviving Delays and Cost Overruns

Here’s a number for you: Construction costs have surged as much as 30% over the past three years, and lead times for critical items like HVAC units or steel beams can stretch 9-12 months for some.

One multifamily investor I know backed out of a contract because the construction costs were too high and the rental income wasn't there.

The takeaway? Flexibility is survival.

Think of your project like an orchestra. If one section is missing instruments, you either find replacements—or rearrange the song.

Protecting Profit Margins When Costs Are Skyrocketing

Steel up 25%. Lumber still volatile. Insurance premiums rising in nearly every market. It’s no wonder so many investors feel squeezed.

But your margin isn’t just in the build, it’s in the management post-closing.

One investor I spoke with saved thousands from monthly operating expenses by installing smart building systems that cut utility bills and detect leaks before they become six-figure problems.

Picture your profits like a bucket with tiny holes. Plug enough of them and you keep most of your water.

Action ideas:

✅ Implement cost-optimization tools and dynamic pricing.

✅ Use AI to adjust rents in real time to match demand.

✅ Invest in sustainable upgrades like solar, which one client used to cut operating expenses by 25%—helping offset rising insurance costs.

Finding Deals and Funding When Everyone Says ‘It Can’t Be Done’

The average construction loan rate has hit 7.5% or higher. Competition for good deals is brutal. Many investors are frozen in place.

But the smart ones aren’t waiting.

Networking and lead generation are the two most important activities right now.

(leads to investors are prospective properties that can be great opportunities)

Networking with other brokers and wholesalers to hear of deals before they come on the market.

And generating potential real estate leads of deals that could be worth investing in.

Explore a lead generation model so you're not just "lucky" but actually in front of motivated sellers or deals ahead of time.

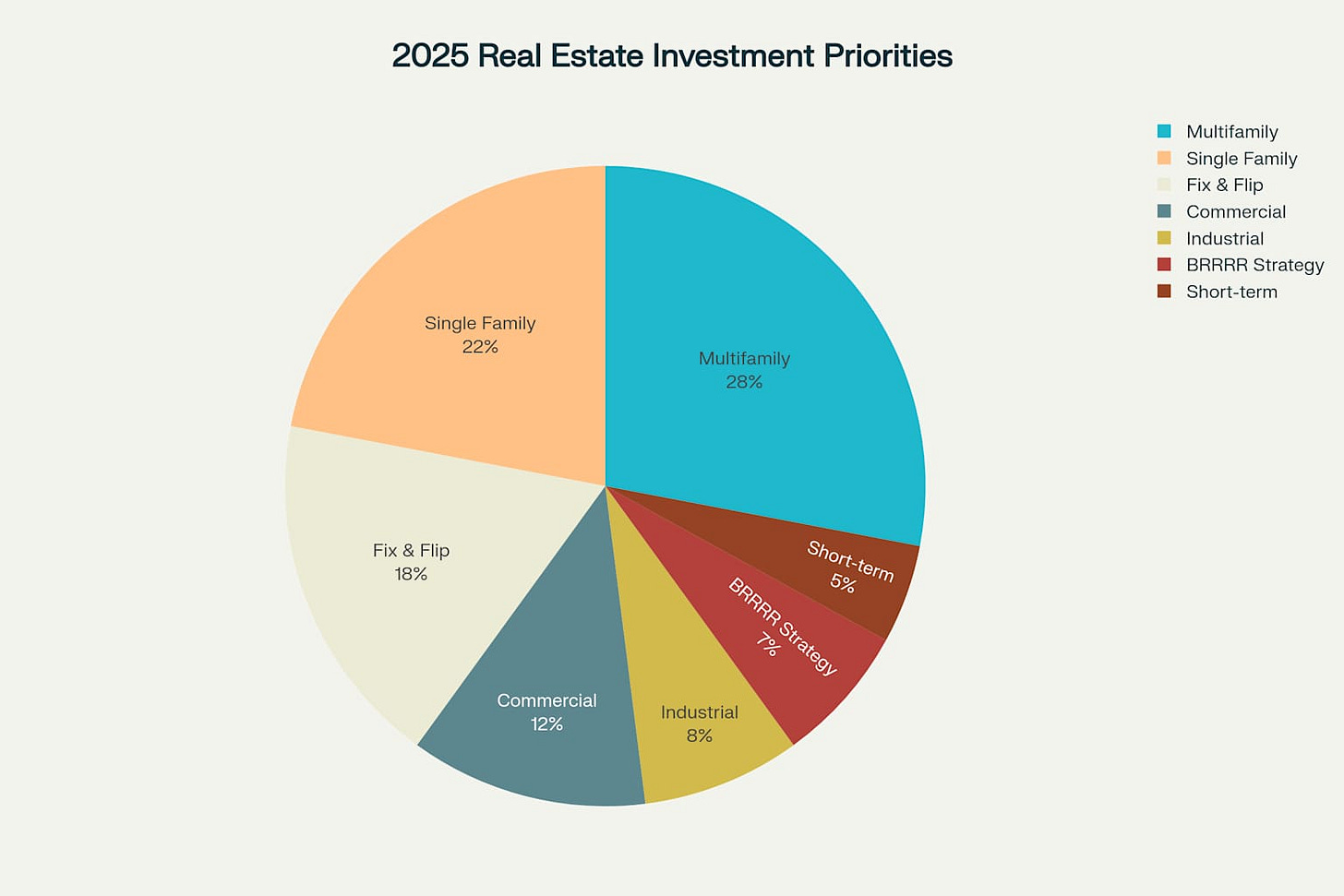

But find your niche and work it like crazy.

Here are the top real estate investing niches right now 👇🏻

Why This Matters

Here’s the reality:

Nearly 70% of investors say they’re “on hold” until prices stabilize.

Meanwhile, smart investors are scooping up deals others overlook, because they’re willing to adapt.

Waiting might feel safe, but it’s often the most expensive choice of all.

Don’t let fear paralyze you. This chaos is temporary, but the gains for those who act could be permanent.

My Final Thoughts

Bottom line: 2025 is not a walk in the park. But it’s also not the end of real estate investing.

And I don't watch the news or care about what mainstream media says. I study my local market, network with other professionals, and play smart.

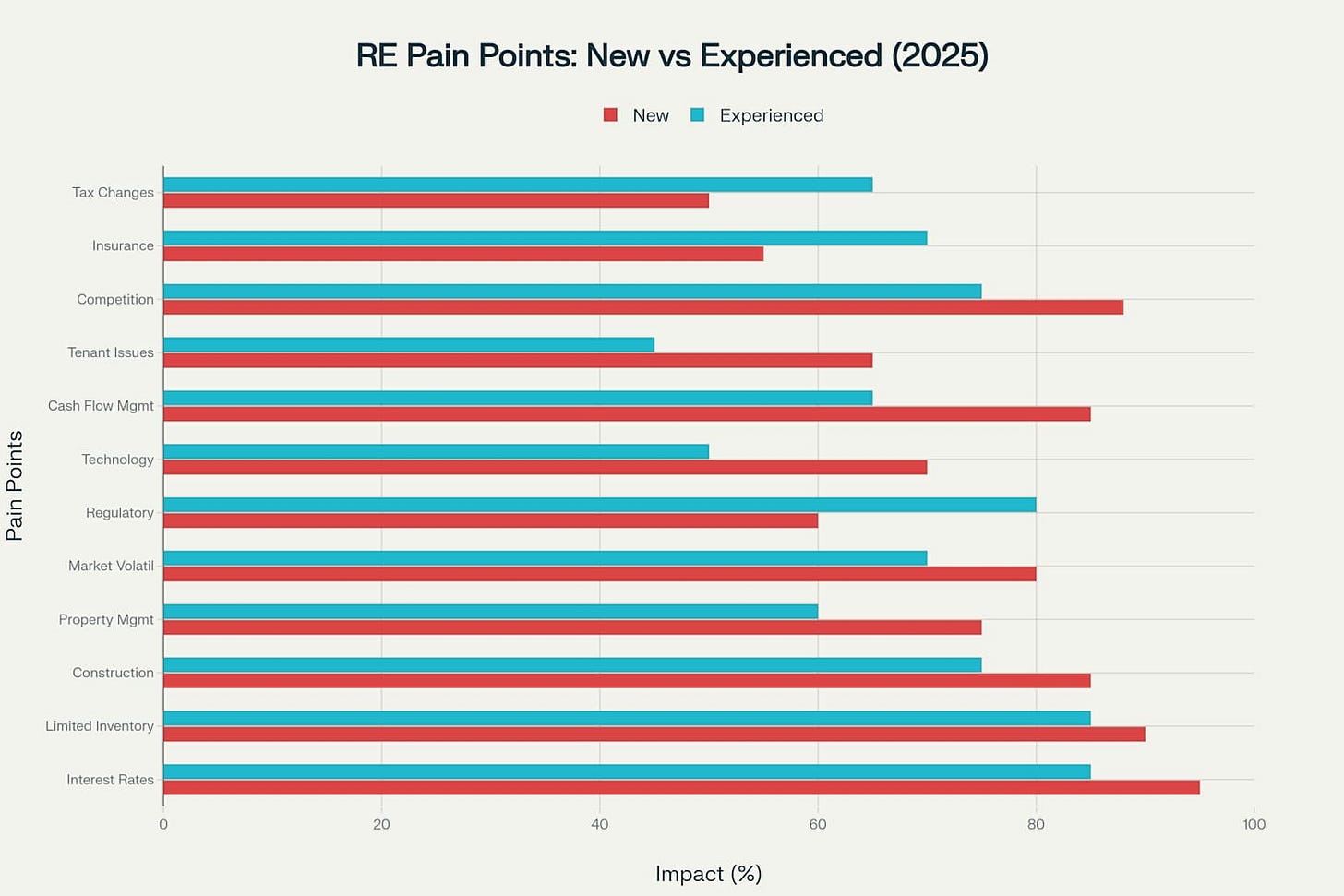

I also highlighted the common pain points that all lot of investors are experiencing right now. Curious to hear your thoughts on this graph 👇🏻

Ready to turn today’s challenges into opportunities?

Schedule a quick call and I’ll walk you through what you qualify for.

No pressure.

Hope that helps.

-Ben Stef | Mortgage Advisor NMLS# 2018674