How Smart Investors NEVER Run Out of Money in Real Estate | Mortgage Advice

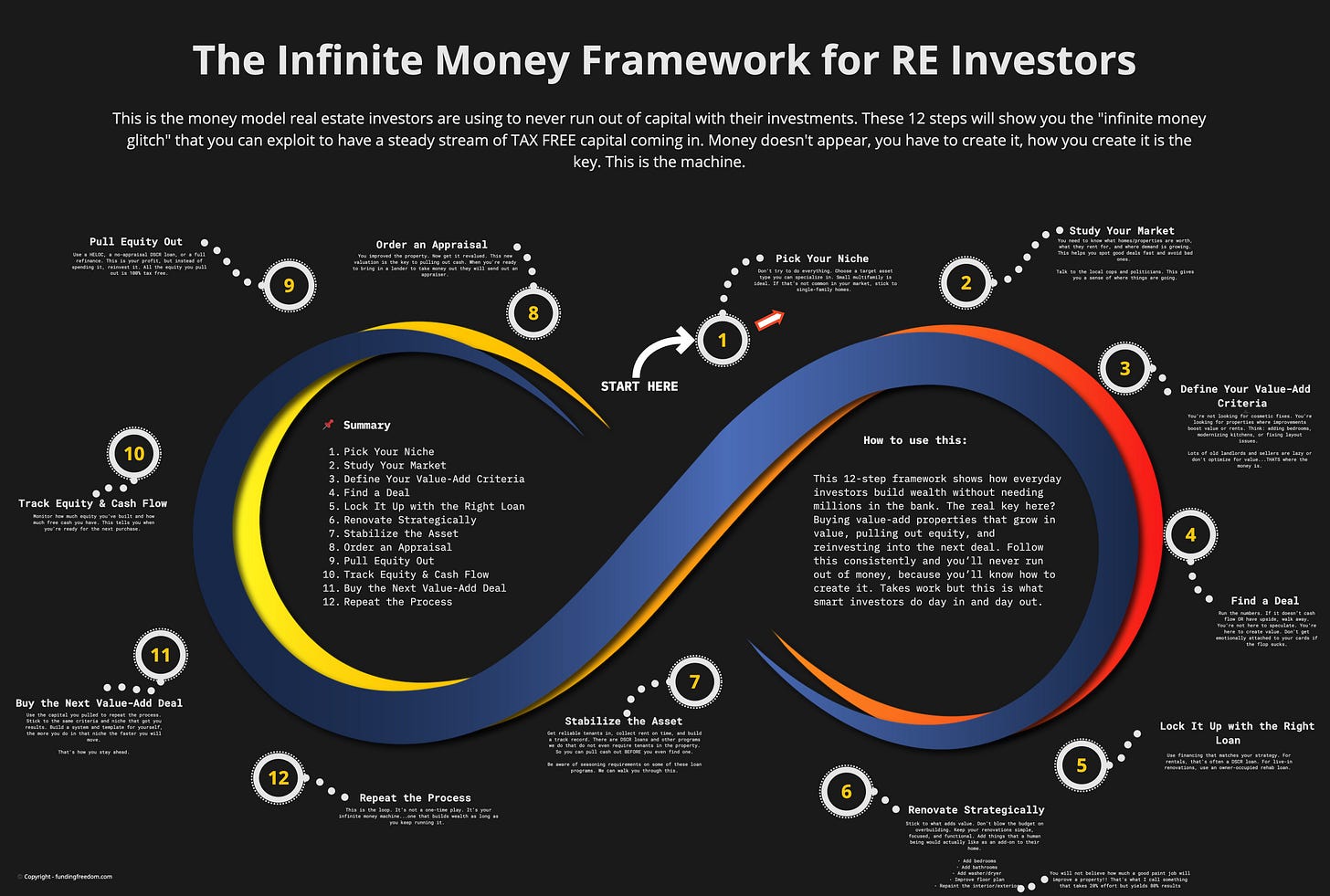

The 12-Step Framework that Creates An Infinite Money Framework

Most people think they need more money to invest in real estate.

They don’t.

They need a process that recycles the same dollars over and over.

The right system turns one deal into the down payment for the next, without a trust fund or a million-dollar line of credit.

I call it the Infinite Money Framework, and it’s how you go from “I can’t afford it” to “I can’t keep up with my own portfolio growth.”

Once you understand that, the question shifts. It’s not, “Do I have the cash?” It’s, “Is this deal going to give me more?”

Every stalled portfolio is just a capital problem in disguise.

But HOW is that possible.

This is where you go wrong.

You find the perfect deal.

The numbers make sense. The location is gold.

But your cash is tied up in your last property. Someone else snatches it. You watch the closing from the sidelines.

That’s not a lack of hustle. That’s a lack of a system…

The best investors don’t hoard capital. They move it.

They buy properties that need work, force the value higher, pull out the equity, and roll it into the next deal. They rinse and repeat. Not once, not twice, but over and over until their portfolio starts compounding faster than they can track it in Excel.

That’s how they scale without a trust fund or a million-dollar line of credit. They build their own money machine.

I call it the Infinite Money Framework

The 12 Steps of the Infinite Money Framework for Real Estate Investing

1. Pick Your Niche

You can’t master every type of deal. Don’t try.

Pick an asset class and stay there. If you’re starting out, stick with small residential (1 to 4 units). It’s the sweet spot. You get strong financing terms, decent rental income, and fewer moving parts than commercial.

If multifamily is rare in your market, go with single-family rentals in working-class neighborhoods. Focus on cash flow and simplicity.

The one who focuses the most will win in 2025.

In the day and age of social media and “I get everything right now”, people are LESS patient and LESS able to just simply focus.

For example I had one investors that wanted to try flipping condos, then he wanted to buy multifamily, then he wanted to try wholesaling.

I’m like buddy you have to stop, you’re never going to go anywhere chasing multiple rabbits. Just chase one.

I have to say this because it’s easy to fall prey to seeing all these successful investors buying up strip malls and casinos but what the everyday investor forgets is that those people have built systems and scaled with certain niches FIRST.

Another example - guy comes to me after starting a web design business, saying he now wants to be a realtor, then changes after a few months to a wholesaling business…It’s like cmon man, of course you won’t be successful you can’t commit.

2. Study Your Market

Don't buy blind.

Spend a few weekends driving neighborhoods. Look at listings. Talk to property managers. Track what things rent and sell for. Over time, you’ll build what’s basically a sixth sense for spotting underpriced deals.

The goal isn’t to memorize every stat. It’s to know when something feels off, in a good way. That only happens if you've put in the reps.

Talk to the local cops and politicians. This gives you a sense of where things are going.

Links I like to use:

hoodmaps.com

spotcrime.com

The local police will give you local government links that reports crime, that’s an important indicator of what’s going on.

Find a market where there’s demand. Doesn’t matter what you think about the area, if the demand isn’t there or there’s too much supply (too man y properties) then no one wants to move there, so be weary of purchasing there.

3. Define Your Value-Add Criteria

Not all repairs increase value. Painting a door doesn’t mean you created equity.

But repainting the whole interior could work.

Focus on improvements that boost rent or raise appraisal value. That means adding a bedroom, converting a layout, or updating kitchens and baths in a way that attracts better tenants.

Don’t renovate like you're moving in. Renovate like a landlord with a calculator.

Lots of old landlords and sellers are lazy or don't optimize for value...THATS where the money is.

Real estate is a sophisticated industry full of unsophisticated people…

For example in my market there are a ton of immigrant families that purchased multifamily properties in the 70’s and 80’s and house hacked, but never optimized for income, those are my favorite deals.

In summary, here are my favorite value adds that reap the highest ROI:

Adding bedrooms

Adding bathrooms

Improving the floor plan (many suck now a days)

Adding washer/dryer

Updating the appliances

Re-painting everything

4. Find a Deal

This is where most people freeze.

Many investors I talk to are in analysis paralysis. They just soak up knowledge and never do ANYTHING.

Don’t just learn, actually apply this stuff.

If you’ve defined your criteria, finding deals is just math. Set up alerts, call agents, walk properties, and talk to wholesalers. Look for properties where you can buy under market value and add real value fast.

Avoid emotional buys. If the numbers don’t work, walk. No one gets rich from buying the wrong property just to “do a deal.”

Here are some ways to find deals right now:

Realtors - they have access to off market deals or clients that they know will sell long before they’re ready

Wholesalers - you have to pay a fee at closing but they find distressed sellers and quickly turn around to sell it to an investor

Direct mail marketing - sending mail to potential sellers

Driving for $$ - physically scout neighborhoods that might have motivated sellers

Distressed properties, foreclosures, or auctions

Networking - continuously meet other professionals as that will bring opportunities to light you didn’t have before simply because of relationships.

There will always be competition in these areas, so don’t think it’s super easy. But if you work enough and network you’ll find the deal.

5. Lock It Up with the Right Loan

Structure your financing so it sets you up for the next move.

But so many lenders out there are really bad at creatively financing deals.

Loan officers don’t THINK like investors…they just take orders. That’s why you need an investor-friendly lender (like me) that genuinely helps you get the cash you need or next property without all the BS and drama.

DSCR loans are the absolute best. No personal income verification, so no tax returns or W2s. You just need to put 20% down and make sure the rental income covers the new mortgage.

This works great because as you scale your DTI goes up with the mortgage payments and there comes a point where you will not qualify with a full-doc loan

They close fast because they don’t ask for a lot of items. Closes in 2-3 weeks usually.

Sometimes doesn’t require seasoning so you can take cash out right away.

If you're living in it and fixing it up, go with a renovation loan like Homestyle or 203k.

Either way, know your exit. You're going to pull equity later. Don’t get trapped with a loan that penalizes you for that.

Here’s a page of a ton of cool loan programs you can check out that we do that helps with this:

https://programs.fundingfreedom.net/

6. Renovate Strategically

You're not flipping for Instagram. You’re upgrading for function.

Focus on clean, durable, neutral improvements. Think good flooring, decent cabinets, bright lighting. Keep your rehab scope tight. Don’t touch anything that doesn’t boost rent or appraised value if you can.

Over-renovating is the fastest way to destroy your ROI.

You do NOT want to be the nicest property on the block OR the worst.

Being in the middle is perfect because you get maximum value.

Another thing investors miss:

Keep. Your. Guys. Moving.

The second the GC leaves, subs and workers take smoke breaks every 10 minutes….I see it all the time.

That’s why you want an aggressive GC who manages his guys well because time kills all deals here.

Try your best to set up accountability systems to ensure that people are moving quickly.

I look for subs that do quality and speed, not necessarily the cheapest.

7. Stabilize the Asset - Find Tenants

Get quality tenants in fast. Collect rent. Document everything.

I highly recommend a system for this as it makes or break your rentals. If you know any property managers, they have a lot of experience in this space and can teach you a lot.

Here’s one I use, I call it the Tenant Trust Filter

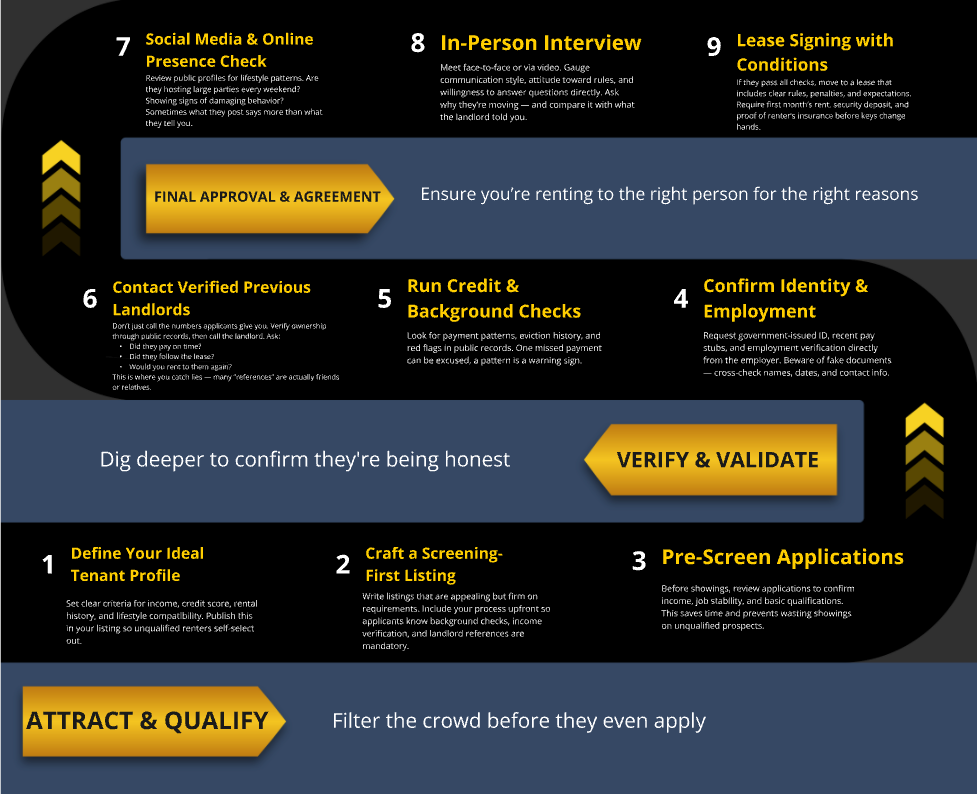

The Tenant Trust Filter

Split into 3 phases with 9 steps to eliminate as much risk as possible.

PHASE 1 – ATTRACT & QUALIFY

Step 1 – Define Your Ideal Tenant Profile

Set clear criteria for income, credit score, rental history, and lifestyle compatibility. Publish this in your listing so unqualified renters self-select out.

Step 2 – Craft a Screening-First Listing

Write listings that are appealing but firm on requirements. Include your process upfront so applicants know background checks, income verification, and landlord references are mandatory.

Step 3 – Pre-Screen Applications

Before showings, review applications to confirm income, job stability, and basic qualifications. This saves time and prevents wasting showings on unqualified prospects.

PHASE 2 – VERIFY & VALIDATE

Step 4 – Confirm Identity & Employment

Request government-issued ID, recent pay stubs, and employment verification directly from the employer. Beware of fake documents — cross-check names, dates, and contact info.

Step 5 – Run Credit & Background Checks

Look for payment patterns, eviction history, and red flags in public records. One missed payment can be excused, a pattern is a warning sign.

Step 6 – Contact Verified Previous Landlords

Don’t just call the numbers applicants give you. Verify ownership through public records, then call the landlord. Ask:

Did they pay on time?

Did they follow the lease?

Would you rent to them again?

This is where you catch lies — many “references” are actually friends or relatives.

PHASE 3 – FINAL APPROVAL & AGREEMENT

Step 7 – Social Media & Online Presence Check

Review public profiles for lifestyle patterns. Are they hosting large parties every weekend? Showing signs of damaging behavior? Sometimes what they post says more than what they tell you.

Step 8 – In-Person Interview

Meet face-to-face or via video. Gauge communication style, attitude toward rules, and willingness to answer questions directly. Ask why they’re moving — and compare it with what the landlord told you.

Step 9 – Lease Signing with Conditions

If they pass all checks, move to a lease that includes clear rules, penalties, and expectations. Require first month’s rent, security deposit, and proof of renter’s insurance before keys change hands.

8. Order an Appraisal

This is where you find out what your sweat and hard work is worth.

Order a full interior appraisal with a rent schedule. Show before-and-after photos. Give the appraiser a list of improvements. Don’t assume they’ll notice.

Appraisers usually cost $500 - $1,000+ depending on the deal size

For rentals, appraisers go out to assess 3 things:

The new property value

The condition of the property (they won’t be SUPER picky but the property has to be livable by some standard

The rental comps

The higher the appraisal, the more you can borrow. This step either validates your work or reminds you that cosmetic upgrades don’t create equity.

Appraisers are usually selected by a 3rd party company that’s connected to the lender, so you don’t usually have a say of who goes out to see your property.

That’s why I vet my appraisers and make sure to use local ones that understand the market.

9. Pull Equity Out

This is where the system pays off.

Use a DSCR HELOC to get a line of credit secured by your property’s rental income. Or a no-appraisal DSCR loan if you want to move fast. Or go with a full cash-out refi to get the lump sum.

The key is you're not relying on W-2 income. You're using the property’s cash flow to qualify.

Keep the asset. Take the money. Move to the next deal.

Normally you can go up to 75% or even 80% LTV if you have good credit scores.

10. Track Your Equity & Cash Flow

You can’t scale what you don’t measure.

Track how much equity you’ve created. Watch your loan balances. Check your cash flow each month. Make sure you’ve got enough reserves.

Use a tool like Stessa or just update your Google Sheet once a week.

Here’s some calculators we made that could help with that: Investor Calculator Bundle

You’re not doing this for fun. You’re building a business. I really think investors need to treat it like one. Don’t fly by the seat of your pants lol.

11. Buy the Next Value-Add Deal

Take the cash you pulled out and use that to pay for the down payment on the next one.

Purchase —> Renovate —> Pull Equity Out —> Do it again

Stick to your criteria. Don’t let a little success loosen your standards. If the last deal worked, repeat it. Don’t fix what isn’t broken just because you got bored.

Keep your scope tight. Run your numbers. Go again.

12. Repeat the Process

This is how real portfolios are built.

One deal creates the next. You don’t stop when you run out of cash. You stop when you run out of discipline (or when you want to, it’s up to you). Keep the loop going and your money never sits still.

This isn’t a one-time play. It’s how you buy freedom over time.

Bonus Tip: Raise Capital If You Need To

If you can find deals but you’re short on funds, bring in a partner. Plenty of people have money and no time. If you’ve got time and skills, you’re a match.

Structure a simple joint venture. Be clear about the terms. Make your investor money and they’ll fund your next one too. That’s another newsletter for another time.

Why This Framework Works

This model works because it removes the biggest excuse people use to stay stuck: “I don’t have the money.”

Good. You don’t need it. You just need to know how to create it.

You’re not betting on luck or the market going up. You’re forcing value, taking control of your financing, and using your own results to fuel your next move.

If you follow this loop, you'll never run out of money again.

—

▶️ Want help structuring your next move?

Let’s chat: https://link.fundingfreedom.net/widget/bookings/stefquickcall

—

Ben Stef

Investor Financing Specialist

NMLS #2018674