House Hacking in 2025: The 3 Easiest Ways to Live for FREE (Even With Higher Interest Rates)

How to wipe out your housing payment and build wealth on autopilot

Most people waste half their paycheck just to keep a roof over their head.

Then they wake up every Monday hating their job, drinking bad coffee, and wondering how the heck they got stuck in this loop lol.

But what if your mortgage was $0…and every dollar you put in built you equity, not your landlord’s?

I will break down 3 real strategies people are using in 2025 to live for free in a multifamily property, even with higher rates.

After helping fund over $10 million in multifamily deals just last year, and I can tell you confidently, this is the most overlooked shortcut to financial freedom.

So here are the 3 fastest ways people are living for free in 2025:

Strategy 1: The Blueprint Hack – Build a 3–4 Unit with 5% Down

Most multifamily listings right now are either overpriced, falling apart, or both. So instead of overpaying for old plumbing and weird carpet, you build your own.

Here’s the play: use a one-time close construction loan that covers both the land and the build—just 5% down.

How It Works:

Step 1: Find a piece of land zoned for a triplex or fourplex and a local builder. Or find land that you CAN get zoned for a multifamily property (2-4 units). Here’s how you can start:

Search zoning first, not listings. Use the National Zoning Atlas interactive map to confirm parcels that already permit triplexes/fourplexes before you ever drive out.

Map local districts. City GIS portals (i.e., Chicago’s Zoning Explorer or 2nd City Zoning) show height, unit limits, and parking ratios parcel-by-parcel.

Find on-market lots. LoopNet land filters, LandWatch and LandSearch all let you save alerts for “multifamily” or “R-3” zoning keywords.

Off-market angle. Pull vacant-land tax rolls from your county recorder and mail owners—many will carry financing or sell at a discount for quick cash.

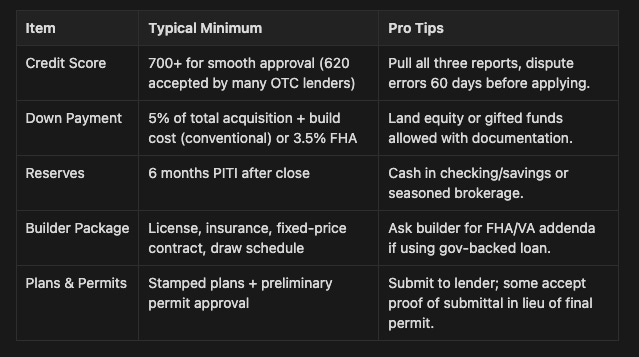

Step 2: Submit your plans, permits, and builder details to the lender (takes about 3 business days). The lender will give you a full checklist of what they need but basically this will be to vet the builder, their experience, and the type of work you’re doing. Your action steps:

Draft a “napkin pro-forma.” Multiply estimated annual rents (get comps on Zillow Multifamily search) by 12, subtract 35% for expenses, then divide by your all-in cost target, land + hard + soft, to make sure you end up at 5%-8% cap rate.

Call at least three local builders. NAHB’s “Find a Builder” directory lets you filter by state and project size. Request fixed-price bids and see whether they accept lender draw schedules—a must for OTC.

Step 3: Close one time. Then construction begins. You make interest-only payments during the build. You’ll usually have a concierge team from the lender (we provide it free for clients) on the construction side help you in this process.

Please note: Lenders usually allow 10% line-item wiggle room, but any scope increase pushing loan cost above the note amount comes out of your pocket at draw time.

Here’s a simple chart to show what I mean:

Step 4: The builder gets paid in stages as work is inspected and completed. Make sure you schedule the inspections ahead of time because the lender needs an inspector before the builder gets their money.

Step 5: When it’s done, the loan automatically converts into your standard mortgage.

Automatic modification. When the certificate of occupancy is issued and the final inspection passes, the loan converts to 30-year fixed without another closing.

Escrow true-up. Remaining contingency funds or interest reserves get applied to principal, lowering your final loan balance.

Renting - Make sure to start marketing the building ahead of time to find tenants. Once you vet them and they sign their leases, then have them move in after the building is complete!

You now own a brand-new building with updated systems, layout you chose, and income-producing tenants.

✅ Minimal down

✅ You control the design

✅ You live in one unit

✅ Tenants cover the mortgage

If you’ve got a 700+ credit score and steady income, I would entertain this idea.

Strategy 2: The Rate Buydown Trick – Cash Flow Without Renovation

If you don’t want to wait 8–12 months for construction then you can move into a cash-flowing property now—without touching a hammer—by structuring your loan the right way.

It’s called a 2-1 buydown, and here’s how it works:

You negotiate seller credits and use them to temporarily lower your interest rate in the first two years:

Year Interest Rate Monthly P&I Savings 1 5.25% $2,885 $679/mo 2 6.25% $3,217 $347/mo 3+ 7.25% $3,564 $0

You’re still in a 30-year fixed loan. You’re just front-loading the savings so the early cash flow is stronger while you stabilize the property.

Why This Matters:

You get 24 months of breathing room

Stabilize rents, build reserves, reinvest the savings

If rates drop, you refinance. Any unused buydown credit goes straight to principal

Most buyers are too focused on getting a price cut. You? You’re structuring smarter.

Strategy 3: The Value-Add Hack – Use a 203k Renovation Loan to Fund the Rehab

This one is slept on and one of the most underrated strategies.

Let’s say the building needs work, but it’s priced below market. That’s perfect.

You use a 203k renovation loan to buy and fix it up—all in one shot. Instead of spending your cash on renovations or juggling multiple loans, this program lets you finance the purchase and rehab in one mortgage.

Real Example:

Buy a 4-unit for $800,000.

Renovation budget? $100,000.

With just 5% down, you can wrap the full $900,000 into a single loan, and the improvements are paid for through the loan itself.

Here's the Quick Breakdown from the 203k Program:

Two types: Limited (under $75K, cosmetic) and Standard (over $75K, includes structural changes)

FHA-backed: Only 3.5% down needed

Covers: Paint, floors, HVAC, kitchens, roofing, even converting unit types or adding ADUs

Includes: Contingency funds for surprises and allows seller credits

Timeframe: Expect 45–60 days to close. Repairs begin within 30 days of closing and must wrap in 9–12 months

Want to add an Accessory Dwelling Unit (ADU)? The 203k lets you convert a garage, basement, or even build new, if it’s zoned though.

The smartest investors are using this to:

Buy ugly properties in appreciating areas

Renovate them with other people’s money

Create instant equity and boost rents before their permanent rate even kicks in

And yeah, there's paperwork and a little more prep work, but that’s what my concierge team is here for.

Keep in mind this is owner occupied only, but investors use it to purchase the property, fix it, move in, then rent it out.

If you’re serious about ditching the 9–5 and building wealth in your sleep, honestly one of these three strategies is your best move in 2025.

Want to find out which one fits your income, goals, and timeline?

Schedule a quick call and I’ll walk you through what you qualify for.

No pressure.

Hope that helps.

-Ben Stef | Mortgage Advisor NMLS# 2018674